Versatility in payment methods and languages

The payment gateway processes payments seamlessly behind the scenes with automatic currency conversion and global reconciliation processes. A suite of popular payment methods helps to reach buyers in locations where specific wallets are preferred.

Intelligent payment routing

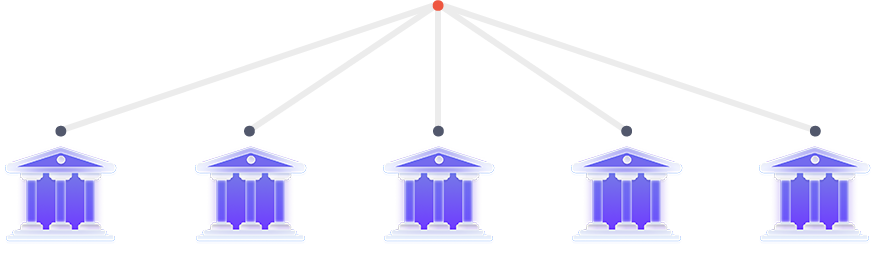

Failover transactions

Any transaction which hasn't been accepted by a specific acquiring bank is automatically furnished to another acquiring bank. This process, known as "failover" or "cascading", enables to cut the rejection rate since that other bank might enforce differing requirements or risk policy.

The failover mechanics help to match a wide range of buyer profiles with appropriate acquiring banks.

Fully customised and AI empowered

upayers® merges the complete customisation by associates and AI capabilities in order to analyse the data in the merchant account and see unique patterns. The associates review customer data and implement optimised intelligent routing mechanics with constant improvements cycle powered by AI‐derived insights.

The team regularly revises the strategies, searching for potential upgrades to the customised e‐commerce payment gateway to keep in sync with changing market conditions.

The internal engine automatically reviews the meta‐data for the transaction (region, country, currency, amount and more) and identifies the best‐fitting local acquiring bank. Since the issuer and acquirer share the geolocation, merchants see a higher approval rate for their transactions.

The extensive network of acquiring banks partnering with upayers® helps to eliminate any friction throughout the customer journey globally.

Buyer

Payment processor & merchant account

Acquiring banks globally

Simplified integration across major platforms

Hosted payment page

e‐commerce sites connect to the external payment page within minutes. The system hosts the payment gateway, assuring full security compliance and due operation. It suits evolving teams with budgetary limitations.

API‐powered integrated page

The payment system is compatible with all major CMS. The associates take charge of all technical processes, relieving merchants. 3D Secure, PCI compliance and tokenisation empower to experiment with loyalty campaigns and subscriptions models. A robust RESTful API enables smooth migration between platforms. Fits best for global expansion.

Robust reporting and reconciliation tools for efficient growth

Intuitive dashboard

The real‐time data generation helps to see a crystal-clear picture. The intuitive UI/UX offers templated reports as well as full‐scale customisation. A frictionless export process ties upayers® with the merchant's preferred BI tool.

Easy reconciliation process

All data is pulled within a single, multi‐currency storage space. Global e‐commerce businesses find it easy to access the in‐depth data, without any labor efforts on their part. All it takes is one integration with the system.

Uncover important data points

High granularity helps e‐commerce to pinpoint areas of success and lag. Analyse sales by region, country, type, currency and more. The root causes of chargebacks and refunds are identifiable, enabling merchants to develop robust defence mechanisms quickly.

End‐to‐end security assurance