Security updates

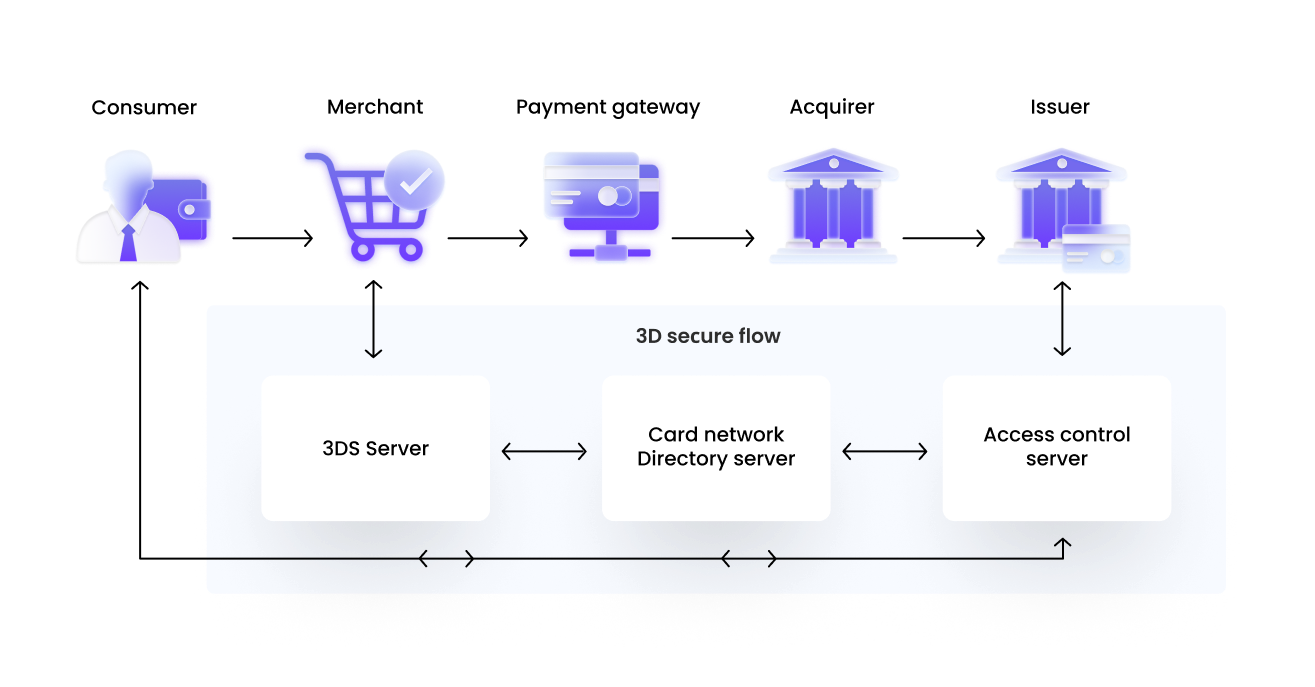

Protection of the transactions with 3D Secure 2

It leaves room for future payment methods to develop and fit in — it anticipates the future ways of buyers to authenticate their personas and reduce fraud.

Payment flow of your client

Strong customer authentication

It ensures electronic payments to be completed only after the successful multi-factor authentication to increase the overall security level of online payments.

SCA elements explained

SCA compliance is a requirement of PSD2, which provisions building an additional authentication to implement to the payment flow.

Payment Services Directive

It is a set of rules and laws, provisioning the payment industry's operation created to make European transactions more protected, boost innovations and help banks and financial services adopt the latest technologies.

All of the above security changes and improvements are made to comply with the updated directive.